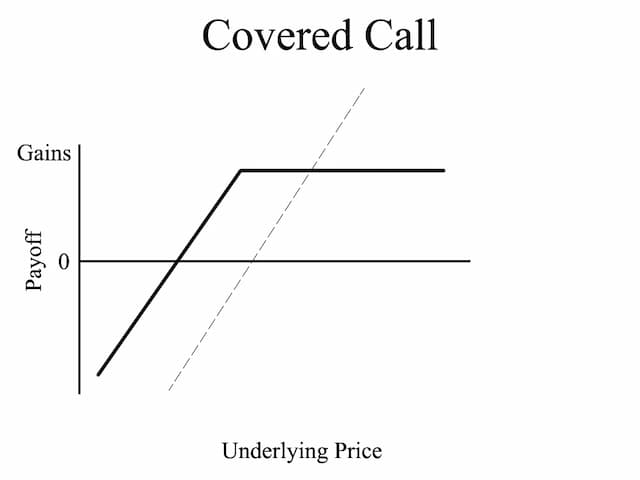

The covered call position (also called buy-write position) is created when you either buy or pre-own a stock and sell call options on that stock. If the call options are exercised the trader will sell the stock at the strike price, and if the call options are not exercised the trader will keep the stock. Usually, call options are sold out of the money. But, If you think that the stock price will go down, and you are still willing to hold your stock position, you can sell an in the money call option.

When to Use: This is often employed when an investor has a short-term neutral to moderately bullish view on the stock he holds. He takes a short position on the Call option to generate income from the option premium. Since the stock is purchased simultaneously with writing (selling) the Call, the strategy is commonly referred to as “buy-write

Risk: If the Stock Price falls to zero, the investor loses the entire value of the Stock but retains the premium, since the Call will not be exercised against him. So maximum risk = Stock Price Paid – Call Premium

Reward: Limited to the Premium. (Maximum loss if market expires at or below the option strike price). Upside capped at the Strike price plus the Premium received. So if the Stock rises beyond the Strike price the investor (Call seller) gives up all the gains on the stock.

Breakeven: Stock Price paid - Premium Received

Profit when: The underlying security closes below the strike price.

| Current Nifty index | 120000 | |

|---|---|---|

| Call Option | Strike Price (Rs.) | 12100 |

| Paying | Premium | 50 |

| Paying | Break Even Point (Rs.) (Strike Price + Premium) | 12150 |