When you long an option, it simply means that you buy it with the expectation that it will rise in value. A long call gives you the right but not the obligation to buy a security at a particular price. Call options are often used as an alternative to buying the stock directly. Since there is no limit as to how high the stock price can be at expiration date, the profit potential is “unlimited”. Also, in options trading, you avoid all of the risk that would result from direct ownership of a security.

Note: Buying too many options increases the risk as, call options have a limited lifespan. If the stock price does not move above the strike price before the option expiry, the option will expire worthless. When options expire worthless, you will lose your entire investment. On the other hand if you own a security, it will still be worth something.

When to Use: Investor is very Bullish on a stock / index.

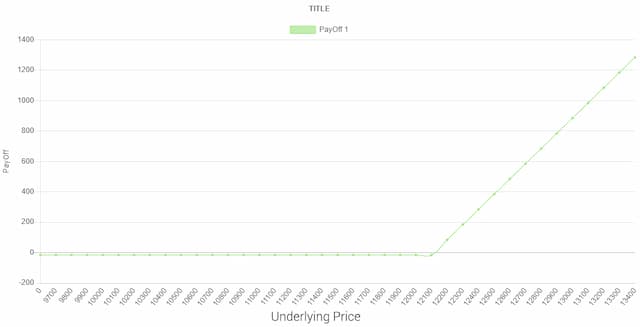

Risk: Limited to the Premium. (Maximum loss if market expires at or below the option strike price).

Reward: Unlimited

Breakeven: Strike Price + Premium

Profit when: The underlying security closes above the strike price.

In the above figure, we have underlying price on the 'X' or the horizontal axis and Payoff/profit on the 'Y' or the vertical axis.

| Current Nifty index | 120000 | |

|---|---|---|

| Call Option | Strike Price (Rs.) | 12100 |

| Paying | Premium | 50 |

| Paying | Break Even Point (Rs.) (Strike Price + Premium) | 12150 |

This strategy limits the downside risk to the extent of the premium I paid (Rs.50). But the potential return is unlimited in case of rise in NIFTY. A long call option is definitely the simplest way to benefit if you believe that the market will make an upward move and is the most common choice among first time option traders. As the price of the security rises, the long Call moves into profit more quickly.