You create a long combo, when you are bullish on a security. A Long Combo option strategy involves selling one out of the money Put option and buying one out of the money call option. Now , the important thing to remember here is that in case of an out of the money put option, the strike price will be lower than the current market price for the stock. And in case of an out of the money call option, the strike price will be higher than the current market price for the stock. As the stock price rises, you start making profit. This strategy is also known as Synthetic Long Stock due to the similarity in the risk/reward profile.

When to Use: Investor is Bullish on the stock.

Risk: Unlimited (Lower Strike + net debit)

Reward: Unlimited

Breakeven: Higher strike + net debit

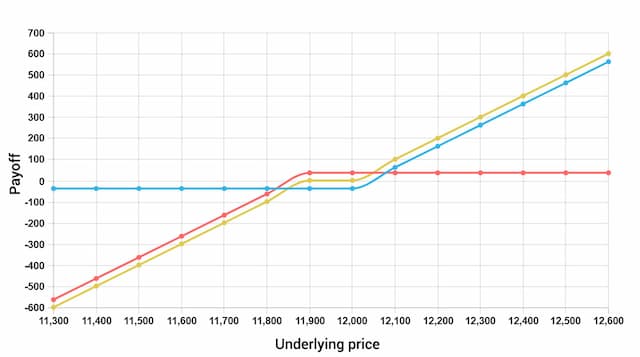

In the above figure, we have underlying price on the "X" or the horizontal axis and Payoff/profit on the "Y" or the vertical axis. You should also notice that there is a gap between the strikes.

| Stock sold | Current Market Price(Rs.) | 11943 |

|---|---|---|

| Sells Put | Strike Price (Rs.) | 11900 |

| Received | Premium | 100 |

| Buys Call | Strike Price (Rs.) | 12000 |

| Payed | Premium (Rs.) | 150 |

| Net Debit (Rs.) | 50 | |

| Break Even Point (Rs.) | 12050 |