Buying a Put option is just the opposite of buying a Call option. You buy a Call option when you are bullish about a security. When a trader is bearish, he can buy a Put option contract. A Put Option gives the holder of the Put a right, but not the obligation, to sell a security at a pre-specified price.

A long Put is a Bearish strategy. To take advantage of a falling market an traders buy Put options. If the price of the stock falls, the put option increases. This is one of the most commonly used strategy when an investor is bearish.

A long put is also used by traders in order to hedge against unfavorable moves in a long stock position. This hedging strategy is known as married put.

When to Use: The underlying security closes above the strike price.

Risk: Limited to the amount of Premium paid. (Maximum loss if stock / index expires at or above the option strike price).

Reward: Unlimited

Breakeven: Stock Price Premium

Profit when: The underlying security closes below the strike price.

Loss when: The underlying security closes above the strike price.

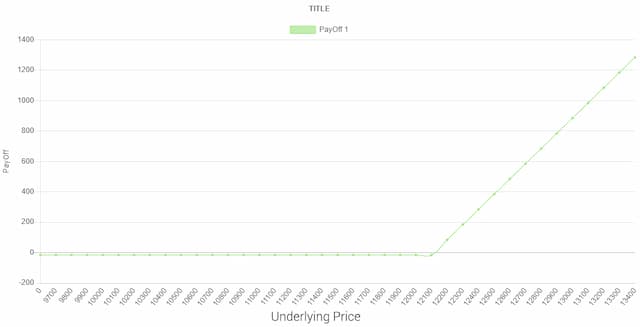

Covered Call Payoff Chart: In the above figure, we have underlying price on the "X" or the horizontal axis and Payoff/profit on the "Y" or the vertical axis.

| Underlying stock | Market Price (Rs) | 12000 |

|---|---|---|

| Call Option | Strike Price (Rs.) | 12100 |

| Received | Premium | 50 |