We may form a straddle strategy when we expect the stock price to show large movements. In order to create a long straddle, we buy one ATM call option and one ATM put option on the same stock for the same maturity and strike price. Doing this, we are able to take the advantage of the market whether it goes up or comes down. If there is an increase in the stock price, the call is exercised and the put expires worthless. On the other hand, if the price of the stock decreases, the put option is exercised while the call option expires.

When to Use: The investor thinks that the underlying stock / index will experience significant volatility in the near term.

Risk: Limited to the initial premium paid.

Reward: Unlimited

Breakeven: Upper Break even Point = Strike Price of Long Call + Net Premium Paid Lower Break even Point = Strike Price of Long Put − Net Premium Paid

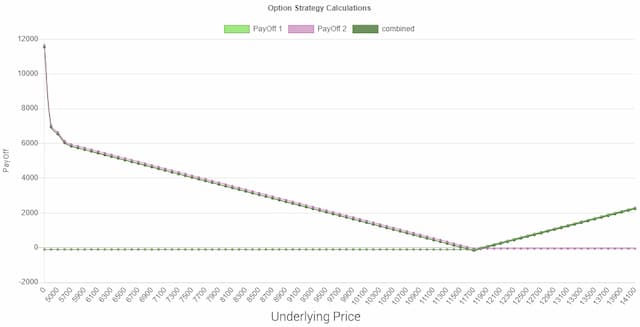

Long Straddle Chart: In the above figure, we have underlying price on the "X" or the horizontal axis and Payoff/profit on the "Y" or the vertical axis.

| Nifty index | Current Value | 11700 |

|---|---|---|

| Call and Put | Strike Price (Rs.) | 11750 |

| Payed | Total Premium (Call + Put) (Rs.) | 207 |

| Break Even Point (Rs.) | 11,957 (U) | |

| (Rs.) | 11543 (L) |